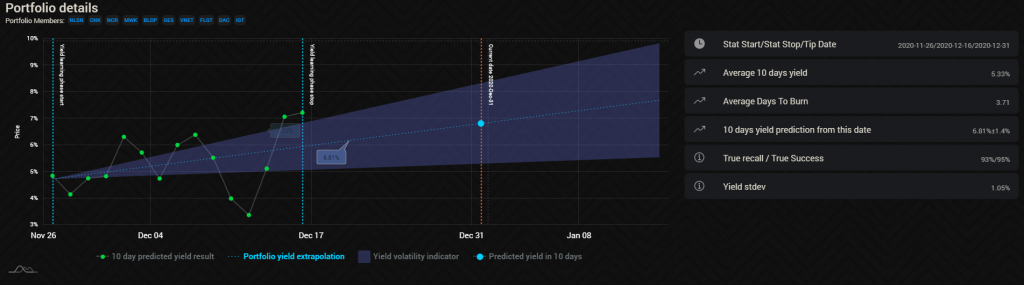

Portfolio chart

Yield learning hase

This phase calculates yield by running micro simulations starting at each day. The green dot represents the total yield of the portfolio for the next N days (based on the prediction it’s usually 10 trading days) if the simulation were started at that day.

A regression curve is fit on the yields to best estimate how predictable and profitable the portfolio is. Also the standard deviation of the yields is calculated.

The last available evaluation date

The most recent trading date from which we evaluate the latest prediction for the portfolio and also the most current date from which we make a prediction for the portfolio

How a good portfolio chart should look?

Usually portfolios are aim for steady, robust growth with non-pulling members (there are not a single member that is dominating, see price chart below) and member stocks which price usually change in a different direction. Also a good portfolio is a portfolio with members that are usually successfully predicted using the prediction signal (green dots are distributed around the regression curve). We should not aim for a very high yield portfolio but a regression curve that is steady or somewhat rising. Too steep rising, even for a portfolio might burn out too soon.

Main parameters

Stat Start/Stop date

The earliest and latest point from where yield predictions were made and calculated, usually the latest point is M days before last available trading date

Average 10 days yield

Mean of the yield of average individual stock yields based on the micro simulation over the N day period taking prediction into consideration

Yield stdev

The smaller the deviation is the more stable the portfolio level yield is on the long run.

Average days to burn

At an average, how many days does it take to completely exit from all positions. Regardless of the burndown value, average yield is calculated based on the advertised prediction prediction distance, that is available for all tiers. Right now the main prediction predicts at least 1% rise within 10 trading days.

N days yield prediction from base date

Based on all previous yields linear regression what is the next N days projection

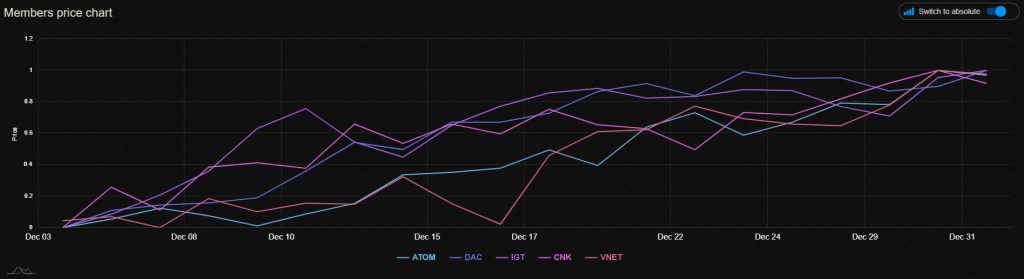

Members price chart

All price changes are displayed for each member on the same chart that is normalized between the min-max range so it’s easier to compare how prices were changed altogether of the portfolio. If you want to see non-normalized values, just use the switch on the top right part of the chart.